Thursday, December 20, 2012

Hard assets vs. fluffy paper..

Interesting divergence between a few hard assets and stock prices... I wonder which reflects conditions more accurately ?

If GLD breaks 150 look for 135 next target...

I ignore the blow off top (which could be thee top) and draw my channel off of the lower trend line which suggests if we blow 150 (triangle support) then expect a hard fast slice down to 135ish before the next long term bull leg begins....

Wednesday, December 19, 2012

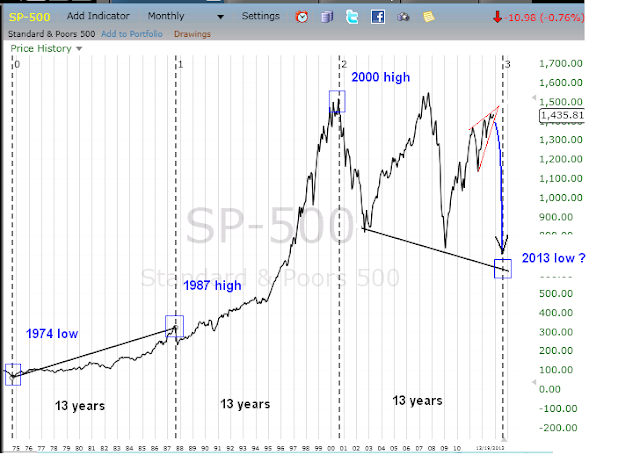

13 year time cycle ?

If you measure from the 1974 SPX low (which would be the lowest price post Nixon's gold detachment) and count the 1987 blow off top pre crash high as the top of the first pure fiat fueled bull leg since Nixon's move (13 years) and measure exactly 13 years more you come to the EXACT fiat pumped high in the year 2000... add another 13 years and all of the increasingly desperate fiat pumpage you find yourself in the fall of 2013. The question is will the fall of 2013 be a high or a low if this anomaly continues ? I suspect it will mark a low....

Interesting technical action in XOM

XOM came back and kissed it's .618 fib level, rolled over and... looks like it stuck it's toe below it's trendline support right at today's close. If it breaks in the morning, I'll be looking for 85ish and would expect XOM to lead the way lower in the stock market...

Dollar supression..

Personally I consider gold a truth detector.. when everyone is corrupt especially those that control money creation, they or their associates and family will trade in and out of gold regardless of what manipulations, schemes or pump operations they are working at any given time. Gold is sniffing out a impending dollar ramp fest and isn't waiting around for the fireworks to start... in my opinion.

As good a place as any to stall out and reverse lower...

/ES so far has retraced to the 75% level of the first leg down off the recent top while at the same time cleaning out all the weak stops. Lets see if she rolls over from right in here....

AAPL's obvious pattern...

So far all AAPL has done in bounce to the area of it's most recent flag or triangle apex and appears to be rolling back into it's down trend.. one could even visualize a measured move target which would be down in the 475ish area and it's lower longer term up channel line...

Monday, December 17, 2012

JJC vs UUPT

Is the the relationship between JJC and UUPT on a short term basis revealing an early signal of copper weakness and dollar strength just over the horizon ?

Friday, December 14, 2012

XOM looks shaky from an "Edwards and Mcgee" pov

If this is a breakout failure which volume suggests could be, the market is about to flush for a few months...

Monday, December 10, 2012

Monday, December 3, 2012

SPY wedge or double top (briefly distorted by bernank)

Interesting area of resistance at the SPY 141.50ish area. We did pop it once but only after Bernank promised to bury the dollar via printing. I'm wondering if this is a longer term terminal wedge or a double top the right side having been blown out by the Bernank's infinite printing comments, either or brings me back to a minimum of 1250 and below as a first target and ultimately 1100ish if it's a terminal wedge for a 1st target longer term.

Subscribe to:

Posts (Atom)